Energy crisis: creating lots of small suppliers was always a bad idea – now taxpayers will foot the bill

Lawrence Haar, University of Brighton

A handful of small energy suppliers in the UK have collapsed in recent weeks because they have been caught out by the massive rise in wholesale gas and electricity prices – and dozens more are in danger of going the same way. If they fail, the government is hoping that stronger energy suppliers will take over their many thousands of customers under the “supplier of last resort” mechanism that exists for such situations.

But this may not happen because of price caps that would force the stronger suppliers to sell energy to these new customers at a loss. Instead, the government faces the prospect of having to take over the failed suppliers, potentially costing the taxpayer millions of pounds. So what is the best way forward?

The UK energy regulator, Ofgem, started encouraging small energy suppliers to enter the market from 2010. This was ostensibly to counterbalance the power of the big six energy suppliers. Whereas these companies are “integrated”, meaning they not only supply customers but also generate electricity and gas, the new entrants were purely suppliers.

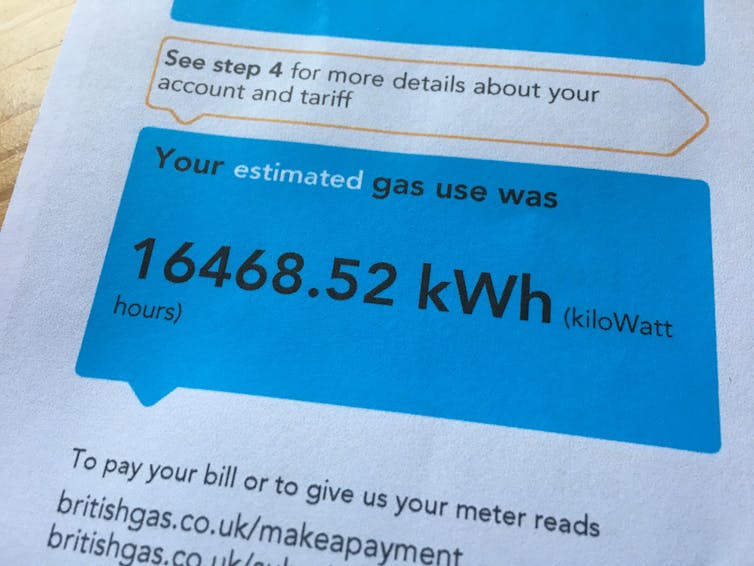

With no more assets than a kitchen table, a laptop and £350, anyone could now become a retail energy company. Scores of small firms made promises that they would save customers money, yet they were exposing themselves to the wholesale energy market with neither the knowledge nor the capital to hedge their risks.

It has not always gone smoothly. In my research, I have seen widespread problems with smaller suppliers: poor customer service, bills that don’t make sense, and heavy-handed debt-collecting practices. Ofgem has said that the Energy Ombudsman receives more severe complaints from customers about the smaller firms than the larger suppliers.

Several dozen of these small firms had gone out of business even before prices exploded, and these frequent collapses naturally overlap with the problems with customer service. To give just one example, the Energy Ombudsman received 1,160 formal complaints about Birmingham-based Extra Energy in 2017, even though it had about 100,000 customers. It went into administration the following year.

Customers’ difficulties are only likely to get worse after a firm goes under. For example, Coventry-based Economy Energy collapsed in 2019, leaving 235,000 customers without an energy supplier, while Newcastle’s Future Energy closed in 2018, leaving 100,000 customers. Months after these collapses, customers of both suppliers were waiting for refunds or balances to be transferred to new suppliers.

Why it’s so tough being small

Being a pure energy retailer in the UK is a hopeless business model for various reasons. They often have a local orientation, like Robinhood Energy in Nottingham or Together Energy in Warrington. This limits their scope for diversifying away from certain weather patterns or customers.

More importantly, they are at a disadvantage when it comes to trading gas and electricity in the wholesale markets to hedge against price fluctuations.

The integrated big six have a distinct informational advantage about the direction of prices. This is because they trade the real-time market in electricity, which the small companies can’t do (and neither can financial institutions, which is why most banks have abandoned electricity trading as a mug’s game).

This enables the integrated companies to hedge in the best way possible against price fluctuations in the energy they need to buy themselves. And the fact that they are also producers means they can adjust their own wholesale prices based on what they think is going to happen. This gives them a “natural hedge” of which pure retail companies can only dream.

Sean Liew

Even if the smaller companies had the credit lines to trade their exposure to the wholesale markets, the volatility is such that they don’t have adequate risk capital to absorb losses and remain solvent. If banks want to trade the gas and power markets, the UK financial regulator requires them to set aside huge amounts of capital to ensure that they remain viable. Yet Ofgem encouraged firms without any assets to take on tens of thousands of customers while becoming hugely exposed to this market.

The way forward

To protect customers against high energy bills, suppliers cannot charge more than the national price cap. This is being raised £139 to £1,277 a year per household from October to help suppliers cope with the higher wholesale prices. But that’s still several hundred pounds below what it now costs to supply power, so it will create a huge reluctance by the surviving suppliers to assume customers of collapsed companies.

Bad policies beget hard choices. Asking the shareholders of economically sound suppliers to take on customers on whom they will lose money can hardly be fair. Yet that is the choice the government now faces. Bail out unviable, flawed companies, or ask surviving companies to pick up the tab.

Damian Czajka

More likely, the government will provide incentives to these suppliers to compensate their costs. This is better than bailing out unviable flawed companies, but it is hardly a long-term solution. The fantasy of relying on pure retail suppliers to lower gas and power prices through competition should be abandoned. And administering prices through price caps should be scrapped: direct grants to the most vulnerable, like the winter fuel payment, should be expanded rather than expropriating the wealth of energy company shareholders for social purposes.

As Ofgem has acknowledged, taxes and levies and network charges now represent one-third of the cost of retail energy (or over half for the poorest households). Much of this represents the cost of subsidising renewable energy, through everything from connecting wind and solar farms to covering the cost of backup power for when the wind doesn’t blow or the sun doesn’t shine.

Honesty about the true costs of renewable energy and decarbonisation, and asking the public directly whether they really wish to pay a great deal more to reduce the UK’s emissions, would be a good start. Maybe we should also be reconsidering producing gas from tight gas seams – in other words, fracking. It is likely to be better for the environment than importing expensive liquefied natural gas.

Lastly, it would make sense to re-commission the Rough gas storage facility off the east coast of England, which played a key role in ensuring the UK had stores of gas for the winter until it was closed in 2017.![]()

Lawrence Haar, Senior Lecturer in Finance, University of Brighton

This article is republished from The Conversation under a Creative Commons license. Read the original article.