Apr

2016

Retailers take on the SmartPhone

Over the past few years, consumers have grown accustomed to having access to the Internet everywhere they go through their smartphones. This of course, has led companies to follow the consumer, by going mobile, too. According to a study done by the IMRG, 16% more people are using mobiles for fashion purchases than other online retail transactions – and retailers have only just caught up with this (2015). The percentage of fashion brands that own a mobile site has dramatically increased over the past three years, from less than half in 2012 to a staggering 80% in 2015.

‘We’re finding out how people shop now: They’re standing in a line at Starbucks, let’s say, and they start browsing on eBay. They see something they want and they buy it right there.’ – John Donahoe, CEO of eBay

A crucial thing for retailers to understand is how to reach the consumer in the best way, by implementing their online activity to the mobile device. Research undergone by the Pew Research Centre claimed that 74% of U.S. smartphone users used their phone to obtain location-based information (2012). Many retailers, such as Walgreens, have stepped up to the plate, by teaming up with apps such as FourSquare, a location based social networking website and app, to offer customers coupons as soon as they entre the Walgreens store. Macy’s offers free Wi-Fi in its stores, which means they can obtain consumer data instantly (by inviting consumers to log in to their network with their Facebook or e-mails) – and customers can scan QR codes on products to see online reviews, prices, and exclusive video content on fashion trends, advice, and tips (Brynjolfsso et al, 2013).

Location-based marketing efforts are becoming increasingly important for local retailers to implement, due to the growing competition from companies in other geographical areas. Local retailers can use location-based apps to rev sales activities up by sending out promotional messages to consumers within the vicinity, or even to people in a competitor’s store. Retailers are learning to respond to consumers using price scan apps in local stores, with more focused promotional offers.

Additionally, the design of the mobile pathway to a companies full website should be recognised. The footwear retailer Schuh, claims that 49% of their site visitors come from a mobile, a further 21% from a tablet; which leaves 30% of consumers visiting from a desktop computer (Durkin, 2015).

2 companies that have successfully gone mobile:

Amazon

Of course, Amazon is constantly being recognised for their effective mobile platforms, with its neat and systematic presentation. Additionally, Amazon’s well-curated, consumer-generated content and reviews creates an easy communication between the consumers and Amazon, while going through their purchase decision process (Brynjolfsso et al, 2013).

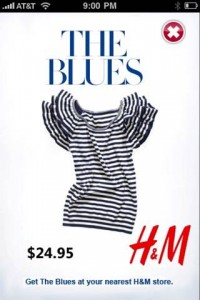

H&M

By partnering with MyTown, a location based app, H&M has gathered and used consumer information to track their locations. Through ‘gamifying’ – potential customers that are playing the game on a mobile device near an H&M store and check-in, H&M rewards them with virtual clothing and points. If consumers scan promoted products in store, it enters them in a sweepstakes to win prizes. Early results of these digital efforts showed that of the 700,000 customers who checked in online, 300,000 went into the store and scanned an item (Davenport et al, 2011).

Critical Analysis:

Avoid direct price comparisons:

Although consumers benefit from easy search, such advances can be damaging to sellers. Taking steps to make direct comparisons difficult can protect retailers from poaching by competitors and alleviate the effects of price competition (Brynjolfsso et al, 2013).

Keep it simple:

Retailers must keep up with the consumer. It’s all about user experience over driving conversion in an obvious way. A few years ago, with web, the more features on a website the better, however, on mobile, people are comfortable having a few number of apps and services that do one function. However, this one function must be done well, fast, and kept simple. Retailers will only be caught out if they don’t address this shift in consumer mentality (Durkin, 2015).

Lessons Learned:

- Focus on location – work with location-based apps to increase online/offline sales

- Make it fun for the consumer – why would they want to download your app if it doesn’t give them exclusive and additional benefits?

- Keep it simple and to the point – create a clean design so consumers don’t get lost and close the app

References:

Brynjolfsson,, E. (2013). Competing in the Age of Omnichannel Retailing. [online] MIT Sloan Management Review. Available at: http://sloanreview.mit.edu/article/competing-in-the-age-of-omnichannel-retailing/ [Accessed 29 Apr. 2016].

Chaffey, D. (2016). Mobile marketing statistics 2016. [online] Smart Insights. Available at: http://www.smartinsights.com/mobile-marketing/mobile-marketing-analytics/mobile-marketing-statistics/ [Accessed 29 Apr. 2016].

Davenport, T., Mule, L. and Lucker, J. (2011). Know What Your Customers Want Before They Do. [online] Spotlight. Available at: http://www.iei.liu.se/fek/svp/mafo/artikelarkiv/1.309630/GruppC1.KnowWhatCustomersWant.pdf [Accessed 29 Apr. 2016].

Davis, B. (2014). A list of 10 retail mobile apps that customers love. [online] Econsultancy. Available at: https://econsultancy.com/blog/64140-a-list-of-10-retail-mobile-apps-that-customers-love/ [Accessed 29 Apr. 2016].

Durkin, R. (2015). How fashion brands are setting trends in digital. [online] Econsultancy. Available at: https://econsultancy.com/blog/66501-how-fashion-brands-are-setting-trends-in-digital/ [Accessed 29 Apr. 2016].

J. Tyler, D. (2014). Segmenting the UK Mobile Fashion Consumer. [online] Aisel.aisnet.org. Available at: http://aisel.aisnet.org/cgi/viewcontent.cgi?article=1001&context=icmb2014 [Accessed 29 Apr. 2016].

Taylor, D. (2013). Predicting Mobile App Usage For Purchasing and Information Sharing. [online] Available at: http://www.davidgtaylor.net/tenure/research/2014IJRDM.pdf [Accessed 29 Apr. 2016].